Funding Reserves: Component Method vs. Pooling or Cash Flow Method

Reserve funds are a vital financial component for various community associations. These funds ensure that these communities can cover the costs of long-term expenditures. There are different approaches to funding reserves, the component method or the pooling/cash flow method. Take a look at the advantages and disadvantages of each.

Component Method: A Detailed Approach

The component method, also known as the “straight-line” method, is a meticulous and detailed approach to funding reserves. It involves conducting a thorough assessment of all components within a property or community that have a limited useful life. These components can include roofs, plumbing systems, elevators, landscaping, and more. The key features of the component method are as follows:

- Detailed Analysis: This method requires a comprehensive assessment of each component’s condition and remaining useful life. Engineers and experts evaluate the specific needs of each component.

- Individual Funding: Reserves are established for each component separately. This means that funds are allocated to cover the projected replacement or repair costs of each component when needed.

- Precision: The component method provides a precise estimate of future expenses, ensuring that funds are available for each component when required.

Advantages of the Component Method:

- Precision: The component method offers a highly accurate assessment of future expenses, reducing the risk of underfunding or overfunding the reserves.

- Transparency: Community members can clearly see how their contributions are allocated to specific components, enhancing transparency and trust.

- Effective Planning: With detailed information about each component, communities can plan for maintenance and replacements more effectively.

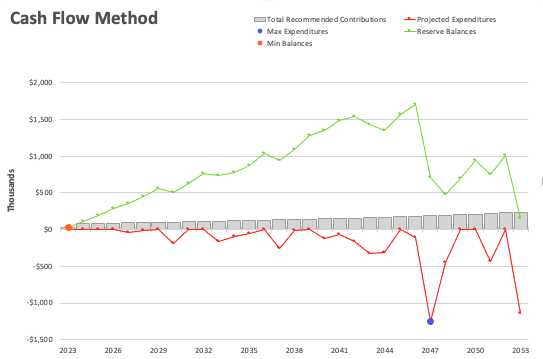

Pooling or Cash Flow Method: A Simplified Approach

In contrast to the component method, the pooling method and the cash flow method take a more simplified approach to reserve funding. These methods involve pooling all reserve funds into a single account and projecting future expenses based on a general assessment of the community’s needs. Here are the key characteristics of the pooling or cash flow method:

- General Reserve Fund: Under these methods, there is a single reserve fund that covers all future expenses, regardless of the specific component.

- General Projections: Future expenses are estimated based on general assessments rather than individual component evaluations.

- Simplicity: The pooling and cash flow methods are more straightforward to implement, requiring fewer resources and expertise.

Advantages of the Pooling or Cash Flow Method:

- Lower Initial Costs: The initial costs of conducting a component-by-component analysis are avoided with the pooling or cash flow method.

- Flexibility: Funds are not tied to specific components, allowing for more flexibility in allocating funds to urgent needs.

Choosing the Right Method

The choice between the component method and the pooling or cash flow method ultimately depends on a community’s specific needs, resources, and objectives. Smaller associations with limited budgets may find the pooling or cash flow method more practical, as it simplifies the process and reduces costs. On the other hand, larger communities with complex infrastructure and a desire for precise financial planning may prefer the component method for its accuracy and transparency.

In conclusion, each method for funding reserves has its advantages and disadvantages, and the choice should align with the community’s unique circumstances and priorities. Regardless of the method selected, the primary goal remains the same: ensuring that there are adequate funds available to maintain the long-term integrity of the community’s common areas and infrastructure.